- +91 9876738803

-

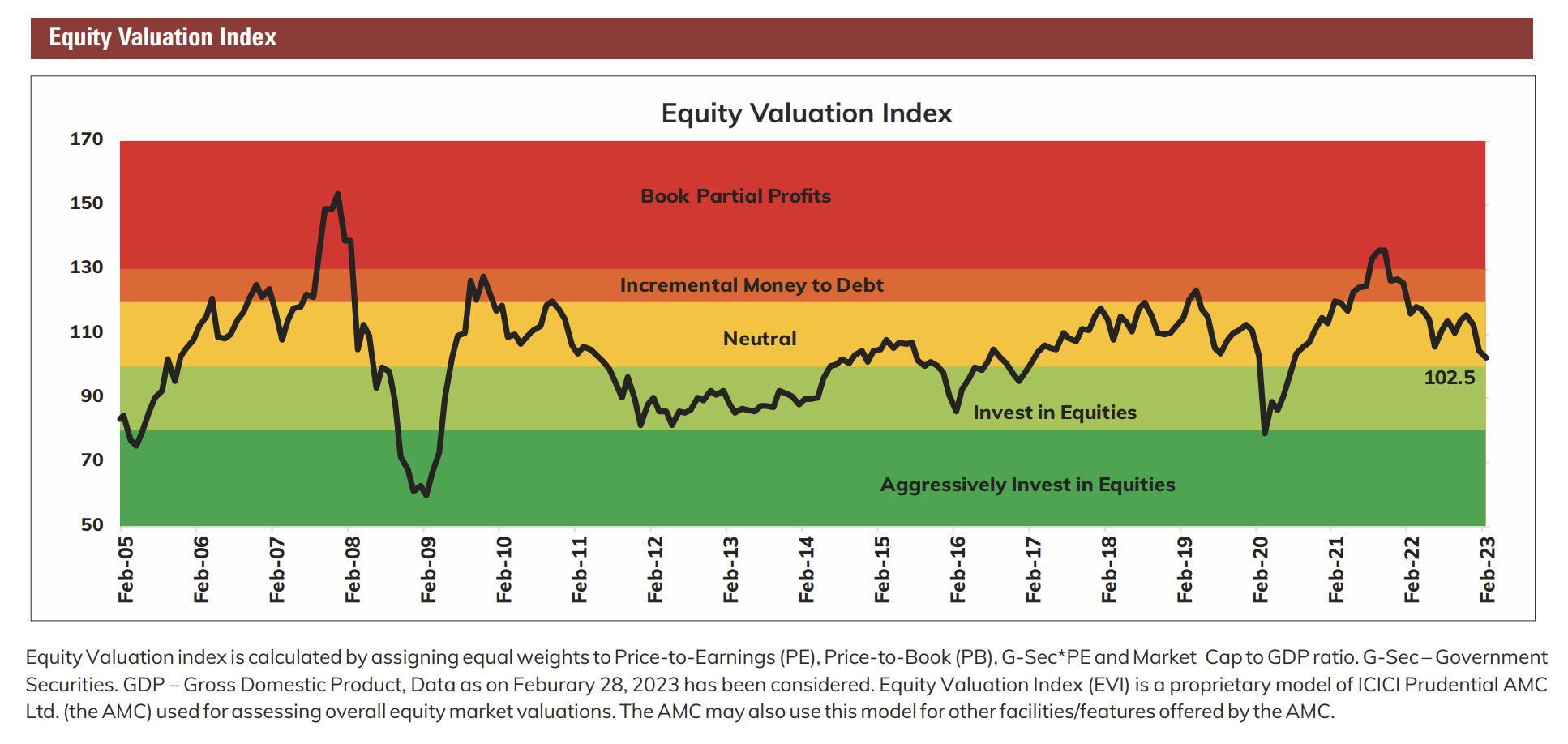

One of the biggest biases in investing is Recency Bias, Which means that participants in the markets would make investment decisions based on the recent turn of events. So if the recent news is good and thus the markets are rising everyone is looking at buying and riding the bull market but if the recent events are negative and markets are falling, no one is willing to buy. This is basically the Greed and Fear at work, When markets are going up we tend to get Greedy and vice versa.

Tags : ,

I am Raghupreet Singh Kanwar, a banking and financial services professional with 26 years in the industry. After having spent 17 years with various banks like, IDBI, ICICI Bank, Citibank and ICICI Securities (Private Wealth) Ltd, I started my own venture on the financial services domain.

Head Office: House no 803, Sector 38 A

Chandigarh 160014

Branch office: Flat no 504, Block 1 My

Home Krishe, Nanakramguda, Gachibowli,

Hyderabad

+91 9876738803

Copyright © Bright Wealth Ideas. All rights reserved. |

Risk Factors – Investments in Mutual Funds are subject to Market Risks. Read all scheme related documents carefully before investing. Mutual Fund Schemes do not assure or guarantee any returns. Past performances of any Mutual Fund Scheme may or may not be sustained in future. There is no guarantee that the investment objective of any suggested scheme shall be achieved. All existing and prospective investors are advised to check and evaluate the Exit loads and other cost structure (TER) applicable at the time of making the investment before finalizing on any investment decision for Mutual Funds schemes. We deal in Regular Plans only for Mutual Fund Schemes and earn a Trailing Commission on client investments. Disclosure For Commission earnings is made to clients at the time of investments. Option of Direct Plan for every Mutual Fund Scheme is available to investors offering advantage of lower expense ratio. We are not entitled to earn any commission on Direct plans. Hence we do not deal in Direct Plans.

AMFI Registered Mutual Fund Distributor – ARN-93495 | Date of initial registration – 19 Feb 2013 | Current validity of ARN – 06 Jan 2028

Grievance Officer- Mr. Raghupreet Singh Kanwar | Raghupreet@brightwealthideas.com

Important Links | Disclaimer | Disclosure | Privacy Policy | SID/SAI/KIM | Code of Conduct | SEBI Circulars | AMFI Risk Factors